Yesterday, Canadians went to the polls to elect Canada’s 43rd Parliament. It was a tightly contested race with a high degree of uncertainty. The outcome – a Liberal minority– highlights a polarized electorate that grew frustrated with the Liberal stronghold on power and has voted for a weakened mandate.

Here is a quick summary of the results:

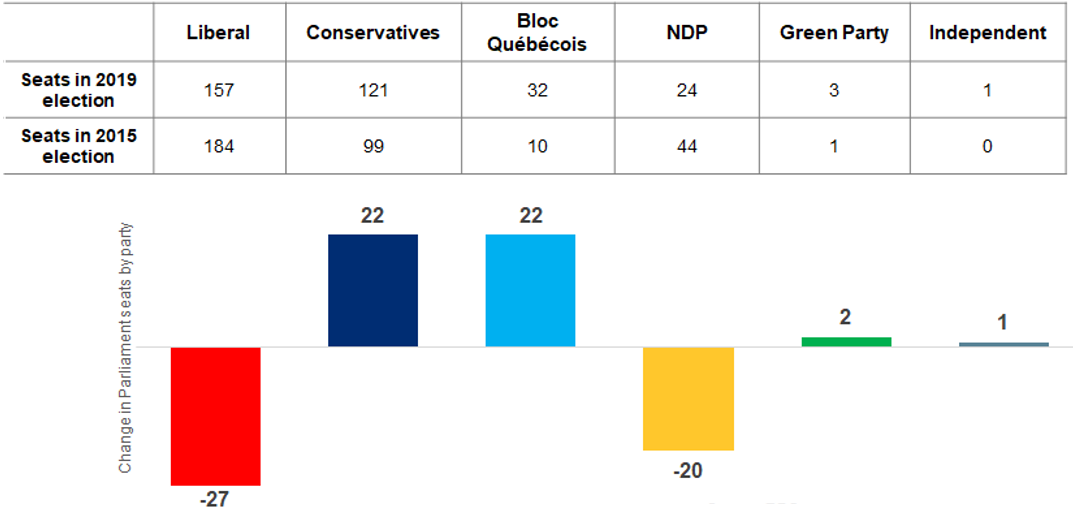

Canada votes: comparing Parliaments

Source: RBC GAM, CBC. As of October 22, 2019.

- Liberals: regained 157 of 338 seats in the House of Commons a net loss of 27 seats and short of the 170 required for a majority. They captured 33.0% of the vote, down from 39.5% support in 2015.

- Conservatives: collected 121 seats, gaining most at the expense of the Liberal party.

- Bloc Québécois: also surged, with the party able to capture 32 seats, regaining recognized party status. A lot of those gains came at the expense of the NDP.

- NDP: won 24 seats, down substantially from 44 in 2015.

While a minority government was by far the most likely outcome, it is now up to the Liberals to form a government that can gain and maintain the confidence of Parliament.

Interestingly, the provincial political backdrop also looks vastly different than it did during the 2015 election. At that time seven of 10 provinces had majority governments run by the Liberals. Since then we have seen a large shift towards Conservative provincial governments, with minorities much more common. Indeed this was evidenced in the share of popular vote, which indicated the Liberals lost some support across most provinces in this election.

Forming a minority government

While tenuous, minority governments are not rare in Canada. Indeed, we have seen 10 of the last 23 elections result in minority governments. They have historically remained in place for about two years before failing a vote of confidence. That said, this outcome does raise questions.

How much will a minority Liberal government be able to accomplish while in power? Will the party be able to form a formal coalition? Or can it agree to work together with other parties in a confidence and supply arrangement.

Governance by a minority party can be achieved in a couple of different forms:

|

At this time the most likely arrangement is some agreement with the NDP. No formal coalition or agreement is necessary, however, until a confidence vote or budget bill is introduced. Regardless of how the government is ultimately able to operate, this likely represents a leftward shift in policy for the foreseeable future.

Under the Liberal party’s weakened mandate, we note several priorities that may now come into focus:

- Energy: A major pressure point between parties is most evident in the energy patch, where the Liberals have pledged to continue the expansion of the Trans Mountain pipeline project. Both the NDP and Green party are steadfastly opposed to it; however, the support of the Conservatives or Bloc could still see progress made on this project. It’s possible all other future project approvals may now be put on hold.

- Government spending: Both the Liberals and NDP have campaigned on a platform of continuing government spending programs and running deficits, albeit at a shrinking pace. Minority governments tend to be more fiscally expansive as they attempt to meet the spending objectives of multiple parties. They often don’t remain in power long enough to focus on the long-term implications for the deficit and overall debt levels.

- Housing: All of the parties campaigned on introducing measures to increase affordability in the housing market. It’s likely we’ll see some new actions here. It’s possible we may see an annual speculation tax on foreign ownership and legislation to help combat money laundering in Canada.

- Telecom: The telecom sector may also come under greater scrutiny. Both the Liberals and NDP focused part of their campaigns on cutting cell phone bills and internet costs. We could see the two parties come to an agreement about how to approach these targets.

- Environment: A minority government introduces the chance that the environmental agenda could receive a material boost should a political stalemate occur. Specifically, the Liberals have focused on carbon emissions, with plans to close the gap between projected and targeted emissions and reach net zero emissions by 2050. We could see these targets expedited under the weakened Liberal mandate. Carbon taxes are expected to continue rising.

- Given that the government is more likely to tilt towards the left, discussions around universal healthcare and a national dental plan could become more topical. Education spending may also come into focus.

Financial markets have responded to these results in a muted fashion, with the loonie essentially unchanged. The formation of a minority government creates greater potential uncertainty.

However, Canada is no stranger to minority parliaments, having experienced them in 43% of all post-WWII elections. Typically there is no definitive path for rates during or after elections. The Canadian dollar tends to take its cues from oil prices rather than political leanings.

Under a Liberal minority we could expect to see larger deficit spending and perhaps a larger Government of Canada bond program for net funding needs. This is not necessarily bad as there does seem to be an undersupply of bonds in the Canadian market relative to demand. These results could also prove to be a mild negative for equity markets, particularly in the energy space, where uncertainty around expansion of pipeline capacity may weigh on sentiment.

From an economic perspective, elections rarely drive a deviation from the current trajectory. This is particularly the case given that none of the parties were campaigning with the focus of taking a hard stance on the deficit or planning to move the needle in a dramatic way. If the Trans Mountain expansion project does become a sticking point and investment in the oil patch dries up, it could lead to modest negatives for the growth outlook.

On the other hand, the increased appetite for running a fiscal deficit may be modestly supportive for rates and the Canadian economy going forward. However, we’re unlikely to see government policy change in a significant way and fiscal policy operates with a big lag. Broadly speaking, Canada still faces four main challenges to its growth outlook:

- slower U.S. growth

- inadequate transportation infrastructure within the oil space

- continued deterioration in Canada’s competitiveness

- a housing market that continues to face long-term vulnerabilities.

This election outcome has not impacted any of these concerns in a major way. As a result we continue to look for below-normal levels of growth from Canada.