At the heart of the capitalist system, there are some fundamental relationships that allow for capital to flow and economies to grow. Some of these relationships are built on trust, and when that trust is violated it erodes confidence in the system, which can in turn have a significant impact on capital markets and the wider economy. Some recent examples of what happens when that trust is lost can be seen in the Enron and WorldCom scandals of the early 2000s and, more recently, the global financial crisis of 2008/09.

One of these relationships is that the owners of a company, the shareholders, trust the board and management to run the company for the benefit of the shareholders. Another is that investment managers – such as RBC Global Asset Management (RBC GAM) – will act in their clients’ best interest when investing capital on their behalf. There is a multitude of regulation, legislation, and international agreements that help ensure that management, boards, investment advisors and asset managers maintain the trust that has been placed in them and thereby ensure healthy capital markets. However, sometimes that is not enough. Many countries have governance codes or guidelines for companies, and some countries, like the United Kingdom and Japan, have developed stewardship codes that seek to establish a baseline of behavior and practices that are expected by the capital providers. While complying with these codes is not legally required, compliance with them reinforces the trust that is so critical.

Recently in the U.S., a group of investors came together to establish such a document. This group, called the Investor Stewardship Group (ISG), included asset managers that represented approximately $17 trillion in assets. RBC Global Asset Management was pleased to be an active participant in the ISG, assisting in developing the “Framework for U.S. Stewardship and Governance”. In this article, we will look at what this initiative is and why it is important for not only U.S., but also Canadian and global capital markets.

The Framework for U.S. Stewardship and Governance

On January 31, 2017, the ISG launched the Framework for U.S. Stewardship and Governance. This was the culmination of several years of work by the ISG and its members to address the unusual situation in the U.S., where there are no formal governance guidelines and no stewardship code. The Framework is a set of basic standards of investor stewardship and corporate governance, and is unique globally as no other country has developed a structure for both corporate governance and stewardship together for a specific market. The ISG plans for the Framework to come into effect on January 1st next year, which will allow firms time to adjust their practices in advance of the 2018 proxy season.

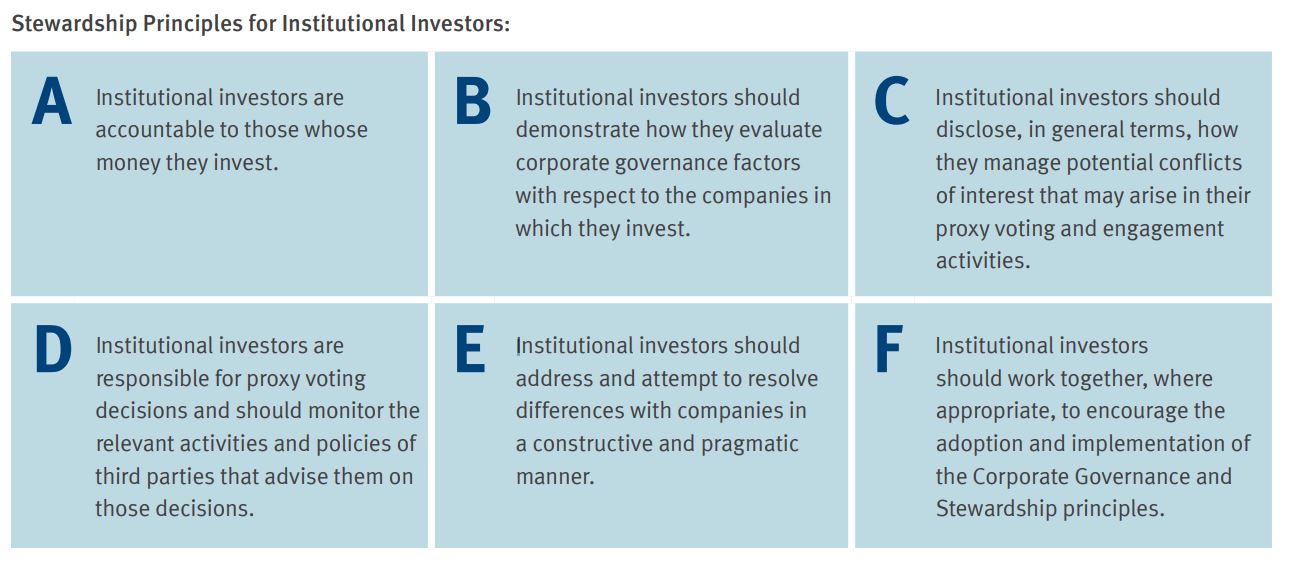

There are two parts to the Framework. The first is the Stewardship Principles for Institutional Investors. These principles provide fundamental guidance for institutional investors as to how they can be good stewards of the capital with which they have been entrusted. In addition, the principles reinforce the expectation that institutional investors should be active and engaged owners that are willing to hold boards accountable when corporate governance standards are not met.

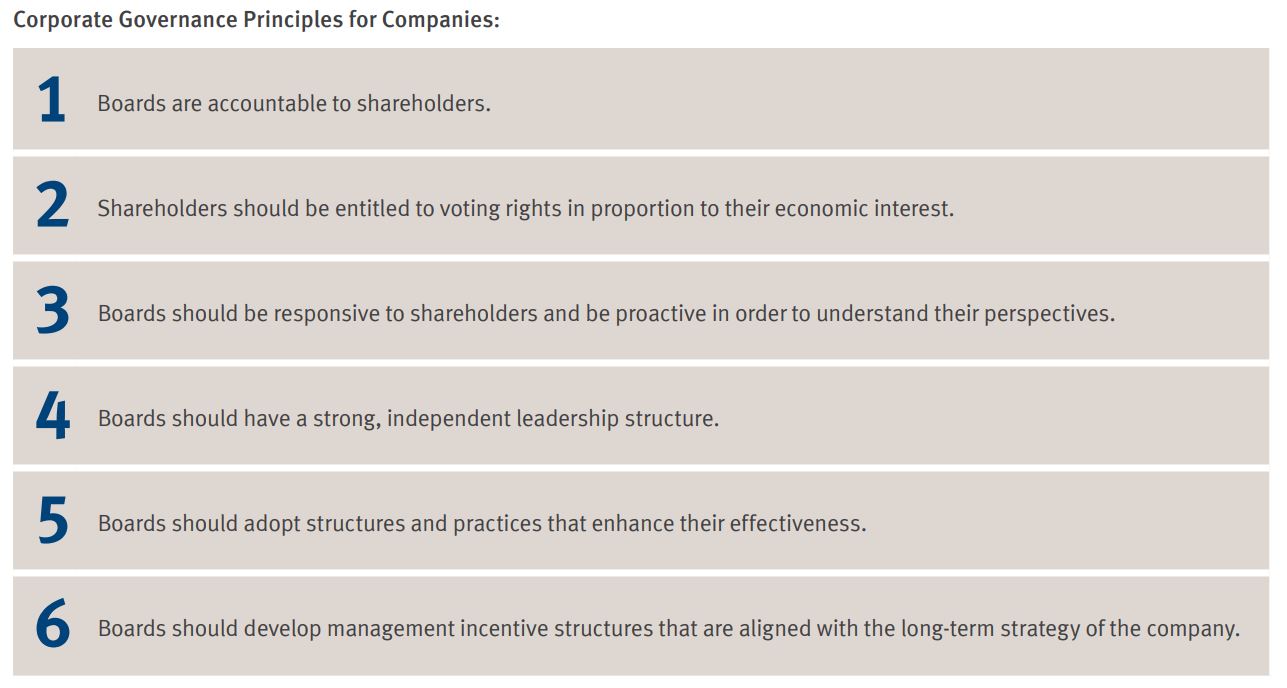

The second part of the Framework is the Corporate Governance Principles for Companies. While these principles are not comprehensive or prescriptive, they detail the minimum standards that investors expect companies to meet. While all investors that participated in the development of these principles have their own unique view as to what constitutes good corporate governance, these principles reflect the minimum standards that are common to all signatories and reflected in their proxy voting guidelines.

Taken together, the principles form a framework for promoting long-term value creation for companies and the broader economy. As mentioned, the Framework is a baseline. Organizations can adopt guidelines and practices that are more stringent if they so choose. In fact, several signatories have proxy voting guidelines that go beyond the basic principles embedded in the Framework. This is the case with RBC GAM. The principles are not static as the ISG intends to revise and update them periodically as best practices evolve.

In the current U.S. political environment, there appears to be significant appetite to roll back much of the regulatory regime that was put in place after the global financial crisis to help ensure better functioning capital markets. This will mean that the burden of ensuring that appropriate standards are being maintained will fall increasingly to large institutional asset owners and managers. In this environment of potentially reduced regulation, the Framework will be an important benchmark against which to measure performance of companies and investors.

Implications for RBC Global Asset Management

While the RBC GAM Proxy Voting Guidelines meet or exceed all of the governance principles contained in the Framework, and RBC GAM already fully complies with the stewardship principles, that does not mean the work is done. The governance principles in particular are a very useful tool to help guide RBC GAM’s engagement with U.S. companies on corporate governance issues. When RBC GAM identifies companies that fall below the standards contained in the corporate governance principles, it will prioritize those companies for engagement, on its own or together with other investors, in order to improve the companies’ practices over time. This demonstrates the value of this initiative. By being active stewards of the investments, investment managers will be a catalyst for improving the corporate governance practices of the companies in which they are invested. In doing so, that trust that is so fundamental to the capital markets will be maintained and hopefully strengthened over the long term.