A brand name can be one of the most valuable assets a company possesses. Not only can it signify quality to consumers and inspire confidence, it can also provide a strong competitive advantage for the business which, in turn, can drive pricing power and higher returns. Brand recognition is particularly powerful in emerging markets (EM), with more than two thirds of EM consumers saying that they would prefer to buy products from brands that they are familiar with.1 In this report, we analyze the power of brands in EM and some of the key themes that will drive brand consumption in the future.

Having analyzed brands across EM and developed markets (DM), we identified four key drivers of brand power:

- Product offering: Brands that are able to create a desirable product that builds customer loyalty and a positive consumer experience are more likely to build stronger brands over a longer period.

- Innovation: With lower barriers to entry and increased competition from smaller brands, innovation has become imperative. To maintain a brand’s market leadership there has to be innovation, not only in terms of product but also in areas such as the distribution and marketing. We believe the brands that will succeed are those that are able to analyze consumer behaviour more efficiently and produce products in a timely manner.

- Distribution networks: Distribution channels have been a key competitive advantage for brand leaders, especially in EM where an ability to reach consumers, particularly in areas of lower accessibility, has been essential to cement leadership. Brands that have been able to integrate digital distribution and create a sound omni-channel presence are more likely to create a more powerful ‘customer reach’ and therefore maintain their competitive advantage in the future.2

- Customer engagement and marketing: Millennials and Generation Z now have a bigger influence on consumer trends and are looking to create a more personal connection with brands. We believe brands that are able to successfully create marketing strategies focused on a more direct form of customer engagement are best placed to benefit.

Exhibit 1: Growth drivers of EM brand consumption

| Urbanization and rising income levels |

|

| The role of digital |

|

| Demographics |

|

| Premiumization |

|

| Rising local preferences |

|

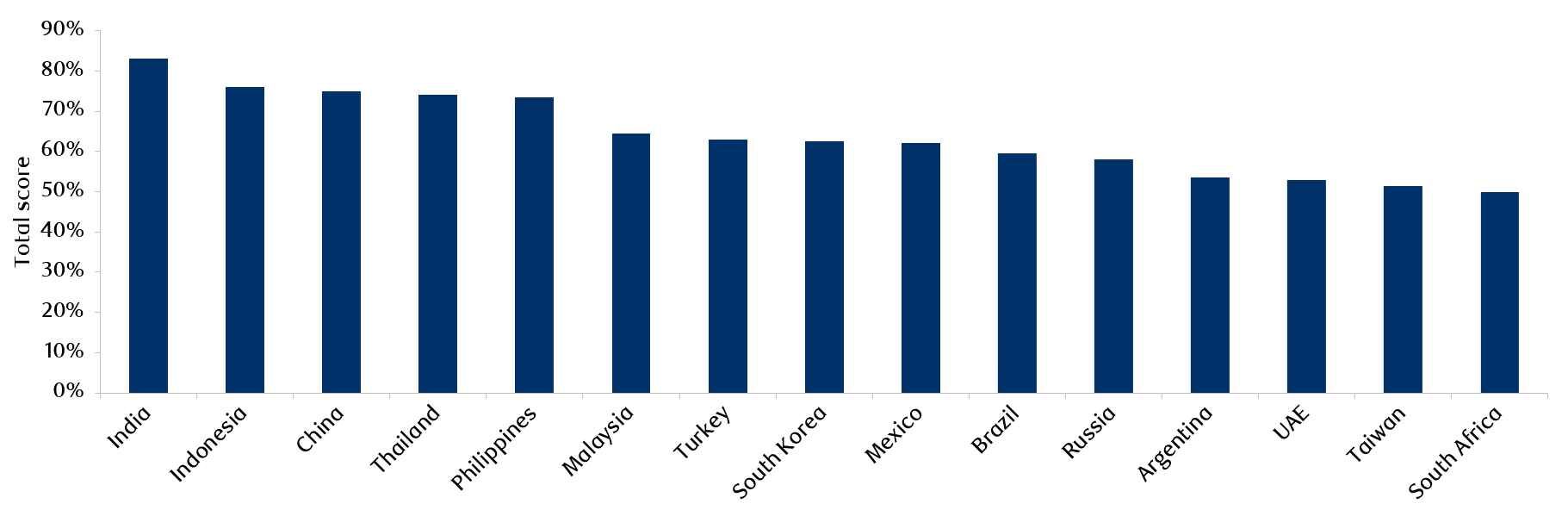

We formulated a scorecard to assess the attractiveness of brand consumption in 15 EM countries. We examined three areas: 1) macro growth drivers, 2) development factors, and 3) support for local brands.

Exhibit 2 ranks the attractiveness of countries in terms of brand investment based on the scores we derived from the analysis. We found that countries such as India, Indonesia and China score very highly due to their attractive growth prospects and a rising middle class population. On the other hand, countries such as South Africa have less attractive growth dynamics, while factors such as high modern retail penetration and private label penetration are creating a competitive landscape for brand development.13

Exhibit 2: EM country scorecard

Source: RBC Global Asset Management, Emerging Markets Brands scorecard. Data as at May, 2020.

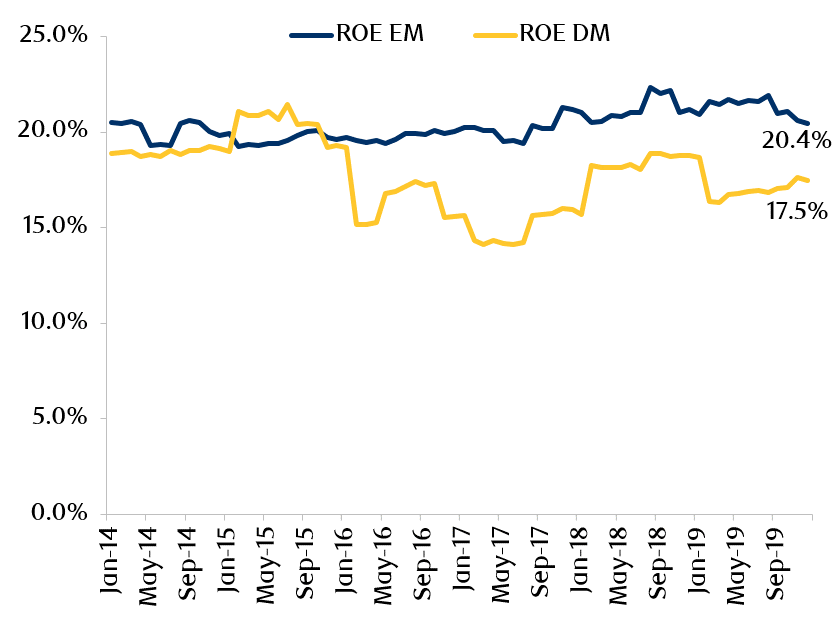

Returns of EM vs DM brands

In order to analyze the returns of EM vs DM brands, we created an equal weighted portfolio of stocks with market-leading brands across various categories and countries. Our research suggests that since 2016 stocks operating strong brands in EM have returns that are superior to those operating in DM. On a country level, we found that China, India, Brazil, Malaysia and Indonesia have a superior average return on equity (ROE) compared to the average ROE of DM (Exhibit 3).

Exhibit 3: EM vs DM brand returns

Source: FactSet. RBC Global Asset Management. Data as at April, 2020.

Themes in brands:

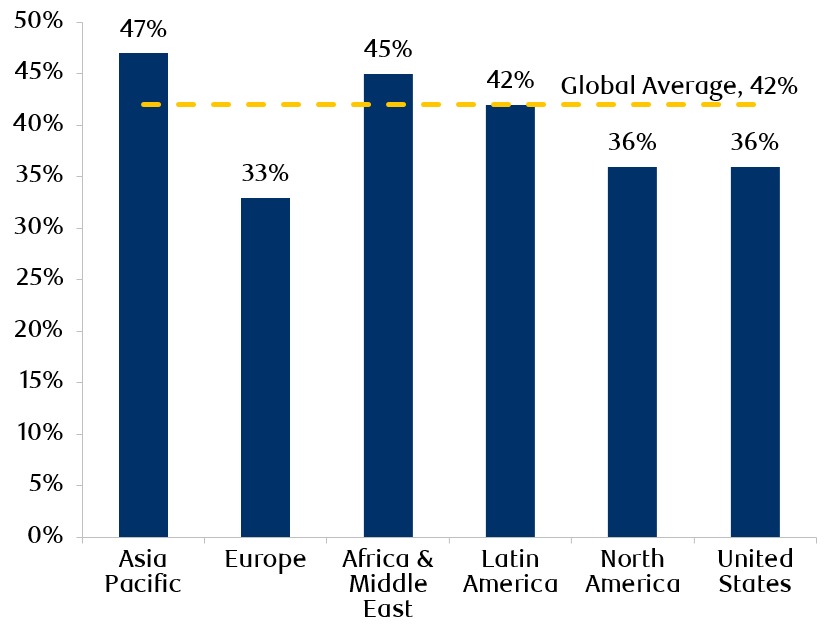

- Millennials and Generation Z: As the generation of Millennials and older cohort of Generation Z (aged between 18-23), who account for more than 50% of global population, reach their prime working age, global consumption is expected to be primarily driven by the spending power and preferences of these younger generations. These consumers are more digitally savvy, have unprecedented access when it comes to the discovery of products and seek to consume experiences rather than things. As a result, these consumers are no longer purely reliant on the “quality stamp” that would come with a brand and are more experimental when it comes to trying new products and brands (Exhibit 4).

Exhibit 4: Percentage of consumers willing to try new brands

Source: Nielsen Global Consumer Loyalty Survey. Data as at March 2019.

- Impact of e-commerce and digitalization: While we expect more competition as a result of lower barriers to entry and from the increase in digital channels, we also believe strong brands will be able to use technology to improve the effectiveness of their products and marketing. They will use tools such as Artificial Intelligence, for example, to provide meaningful insights on consumer behavioural patterns in order to improve the efficiency and pace of innovation cycles. Additionally, leading brands are using digital channels such as social media to improve marketing efficiency and to directly engage with their consumers.

- Disruption: A number of factors, including rising digital/e-commerce penetration and Millennials’ consumption, have given rise to competitive threats to traditional brands, namely direct–to-consumer brands and private label products. Direct-to-consumer brands have succeeded in recent years by targeting those consumers who have grown up in the digital age (known as ‘digitally native’) and younger audiences who are more willing to experiment than older generations, and by focusing on a more personalized and intimate customer experience through the use of social media and various other digital channels. While these smaller brands can disrupt traditional brands and increase the market fragmentation, we believe that factors such as scale and omni-channel presence favour traditional brands over direct-to-consumer brands. Private label penetration is still in the nascent stages in EM given lower levels of modern retail penetration. Overall, while we think private label penetration can increase in EM over the long term as consumers shift towards products offering value for money, we also believe this can encourage innovation among existing brands in order to maintain market share.

- Foreign vs local brands: Local products and brands have become more popular in recent years in EM, particularly as their quality has improved and their prices have fallen. This has been the case in segments such as packaged foods where local producers have a better understanding of local preferences. In future we expect demand for local products to increase as 1) local brands benefit from their stronger understanding of local tastes and preferences; 2) rising nationalism amongst young consumers promotes the consumption of local over foreign brands; 3) the increasing need for transparency on how brands produce and distribute their products; and 4) the shortening of supply chains (Exhibit 5).

Exhibit 5: Average % of multinationals v.s. local companies ranked in the top 5 players per category in EM

Source: Euromonitor & Acuity Knowledge Partners Calculations. Data as at March 2020.

- Premiumization: We expect premiumization in EM to be well supported by factors such as rising incomes and demand for higher quality products. Additionally we are seeing a willingness among consumers to pay a premium for sustainable and customized products (Exhibit 6).

Exhibit 6: Willingness to pay a premium (more than average price) for products that provide the following attributes or benefits

Source: The Conference Board Global Consumer Confidence Survey conducted in collaboration with Nielsen. Data as at June, 2020.

- Luxury brands: We expect rising income levels in EM to be a key driver of growth in luxury brands. According to Bain & Company, Millennial and Generation Z consumers are expected to account for approximately 80% of luxury goods sales by 2035. We believe the shift towards online channels will be supportive for luxury brands, particularly as younger consumers seek an omni-channel experience when buying branded products. We believe the pace of online penetration can accelerate with the growth of luxury online platforms.

Get the latest insights from RBC Global Asset Management.